Whenever you are an initial-go out house consumer, you might come across dilemmas deciding just how much domestic you could potentially manage. One of the largest obstacles you to basic-big date buyers face is actually figuring just what portion of income should go so you can mortgage repayments every month. Maybe you have read that you need to invest throughout the twenty-eight% of the gross monthly income on your own home loan but is it commission suitable for everyone? Let’s take a closer look within simply how much of your income is going into mortgage.

Most of the homeowner’s problem varies, very there isn’t any hard-and-fast rule exactly how far money just be shelling out for their mortgage every month. However, advantages have certain conditions out-of facts to help make yes you do not end stretching the homes budget also narrow.

The latest 28% Signal Having Mortgage repayments

The will-referenced twenty-eight% laws states that you shouldn’t save money than simply you to definitely portion of their month-to-month gross income on your own mortgage repayment, in addition to assets taxes and insurance. This might be called a safe financial-to-money proportion, or a good general tip to possess home loan repayments. Gross income will be your full house income one which just deduct fees, obligations costs and other expenses. Lenders generally speaking check your gross income when they regulate how far you can afford to get in a mortgage loan.

The fresh new 28% code is quite very easy to decide. Let’s say all your family members earns all in all, $5,one hundred thousand every month inside the gross income. Re-double your monthly gross income by .twenty eight to get a harsh estimate regarding exactly how much you could manage to spend thirty days in your home loan. Within this analogy, cannot spend more than just $step 1,eight hundred on your own month-to-month homeloan payment while following 28% laws.

Rule

You are sure that towards twenty-eight% code, exactly what precisely does the fresh new code suggest? As mentioned, the new twenty-eight% signal means cannot spend more than just that portion of the month-to-month earnings on home financing payment once the a citizen. Then chances are you ought not to save money than simply 36% towards the any most other financial obligation (family financial obligation, auto loans, handmade cards, an such like.). This can be several other an effective rule to use if you find yourself seeking determine how far you can afford in place of stretching your budget.

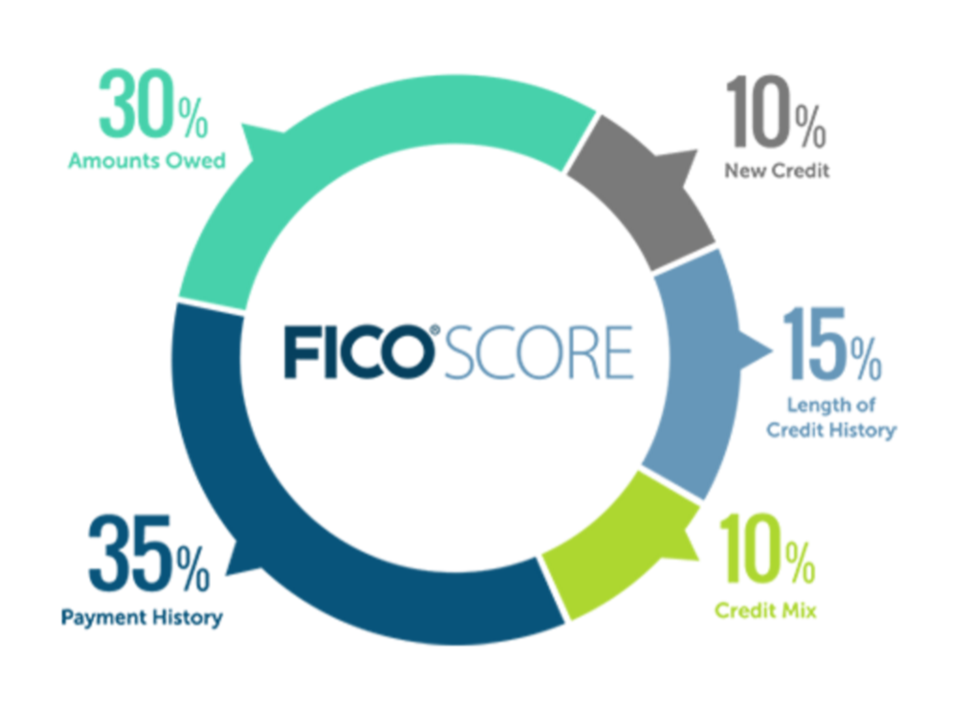

What is My personal Obligations-To-Income Proportion (DTI)?

Loan providers don’t simply look at your revenues when they choose how much you really can afford to carry out from inside the that loan. Your debt-to-earnings ratio plus takes on a primary character in the process.

The DTI proportion is actually a share one to says to lenders how much cash of the month-to-month earnings visits financial obligation and you will repeated expenditures. Loan providers use your DTI proportion after they assess how much you can afford to shell out on your own home loan every month. A higher DTI proportion means that you are a good riskier candidate to possess a mortgage as you reduce disposable earnings. This means its probably be that you may skip a mortgage commission for people who beat your task otherwise come upon monetaray hardship.

Figuring The debt-To-Earnings Ratio

When it comes to calculating their Midfield AL loans DTI ratio, you will need to seem sensible the fixed monthly expenses. Simply lowest repayments and repaired recurring expenditures matter with the your own DTI ratio. Like, when you have $fifteen,100000 value of figuratively speaking but you only have to spend $200 thirty day period, you might is $two hundred on your own personal debt calculation. Don’t is adjustable expenses (such tools and you may transport will cost you) on the computation.

Once you make sense all of your current debts, split your own month-to-month personal debt duty by the terrible month-to-month earnings. Following, multiply the outcome of the one hundred to really get your DTI proportion. In the event the DTI proportion is more than 43%, you might have problems interested in a mortgage. For additional info on calculating their DTI ratio, see all of our over publication.

The DTI proportion and you can earnings are only two facts that your lender considers when they estimate what kind of payment your are able. When you have a high credit history otherwise a bigger down fee, you might still be eligible for financing with additional financial obligation or a diminished earnings. The options nowadays relies upon your mortgage lender’s conditions.

Keep in mind that new 28% rule is only a suggestion to help keep your payment reasonable. The particular part of earnings which you yourself can invest in your own home loan depends on your unique home funds and just how far debt your enjoys. But not, new twenty-eight% tip is a wonderful moving-away from area once you begin purchasing a mortgage.