What exactly is a home Depot opportunity mortgage? How come a project loan functions? Home Depot ‘s the earth’s premier do-it-yourself shop. It had been depending within the 1978 by the Bernie Marcus and you can Arthur Empty. Family Depot have over dos,2 hundred areas in the us, Canada, and you may Mexico. The organization utilizes over eight hundred,100 anybody. Household Depot is a store you to definitely focuses primarily on home improvement and you will design products and services.

Domestic Depot Endeavor Mortgage

For many individuals, the house try our very own most crucial resource. Not only is it a destination to live, but it is also a primary capital. When it comes time to make advancements otherwise solutions, we want to ensure that we’re making the finest choices in regards to our house and you will our very own funds. And here a home Depot Investment Financing shall be a giant help.

That have a property Depot Investment Mortgage, you can obtain as much as $55,100000 for store instructions otherwise recovery-relevant costs. The borrowed funds has actually four levels, as well as the words and you can Annual percentage rate is determined by their borrowing acceptance. Which means you can buy the financing you ought to create the newest developments you desire, without worrying throughout the higher-rates of interest otherwise unanticipated expenses. As useful content well as, you need to use the loan any kind of time Domestic Depot shop around the the world. So whether you are renovating your kitchen otherwise incorporating a unique patio, a property Depot Venture Mortgage makes it possible to obtain the job done properly.

What exactly is a house Depot Opportunity Loan?

A house Depot enterprise mortgage is a great choice for financing house home improvements otherwise organization programs after you do not want to invest the expense upfront. The borrowed funds keeps fixed monthly obligations, very you’ll know how much you ought to finances for each week. And additionally, there is absolutely no yearly fee associated with the loan.

Assuming you determine to pay off the loan very early, possible simply be charged a small prepayment payment. The house Depot enterprise financing can be used to money the newest acquisition of all your opportunity content, so it’s a handy that-end solution for your financing needs.

Property Depot endeavor loan is an excellent cure for loans your residence update projects. Having a maximum amount borrowed from $55,one hundred thousand and an optimum repayment age of seven years, it’s a convenient and you may sensible way of getting the fresh new financial support you would like.

On top of that, this new fixed Annual percentage rate implies that you will know just how much your own monthly premiums would-be for the duration of the mortgage. And if you are shopping for an easy and reasonable cure for funds your future home improvement endeavor, a home Depot enterprise financing tends to be best for you.

According to count your acquire for your home Depot endeavor loan, you are going to pay off an element of the loan month-to-month. Household Depot says that enterprise loan payment won’t be more than $20 for each $a lot of invested.

Is a post on extent you’re going to have to shell out every month, depending on how far you’ve loaned: Borrow $a lot of, pay $20 per month; acquire $5000, pay off $100 a month; obtain $ten,000, pay $two hundred a month; acquire $25,000, pay-off $five-hundred monthly; use 35,one hundred thousand, pay off $700 monthly; borrow $55,100000, pay back $1100.

For that reason, you should thought just how much you are willing otherwise in a position to purchase month-to-month on the do-it-yourself enterprise before you take out financing.

How to make an application for a house Depot Enterprise Loan?

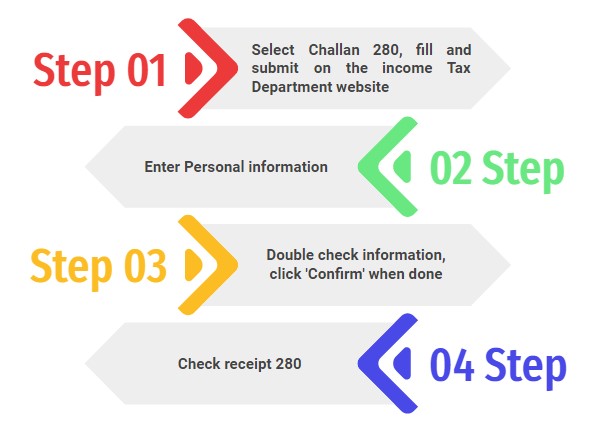

Applying for a home Depot project financing is a straightforward techniques you can do totally online. To begin with, you will have to gather some private information such as your label and you will target, and your credit rating. You can then check out the Household Depot Borrowing from the bank Cardio and begin the application following the newest recommendations here. Usually, it is a comparable technique to making an application for any other kind out-of charge card offered by Household Depot.